Here are some tips for using a compound interest calculator:

- Gather the required inputs:

- Principal amount (the initial deposit or loan amount)

- Annual interest rate (as a percentage)

- Compounding period (annually, semi-annually, quarterly, monthly, etc.)

- Time period (number of years)

- Enter the principal amount in the designated field.

- Enter the annual interest rate, making sure to enter it as a percentage (e.g. 6% not 0.06).

- Select the compounding period from the available options (annual, semi-annual, quarterly, monthly, etc.). More frequent compounding periods will result in higher total interest earned/paid.

- Enter the time period in years that you want to calculate the future value over.

- Click the “Calculate” button.

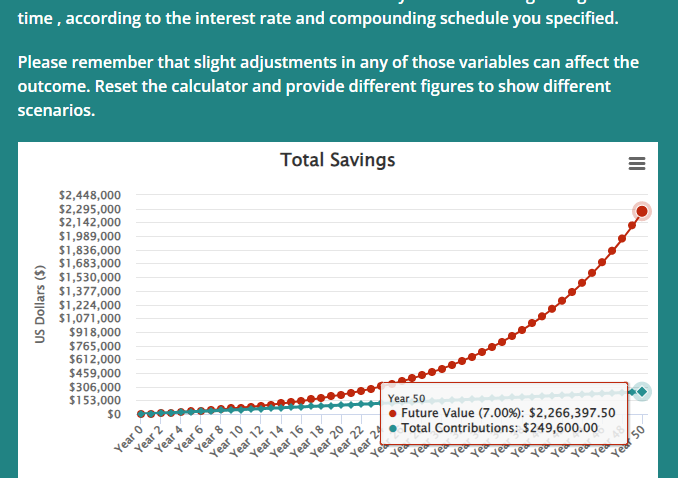

- The calculator will provide the total future value including compound interest earned/paid over that time period.

Some advanced calculators may also allow you to:

- Add additional contributions at set time intervals

- Select to calculate the future value or the required periodic payment

- See a chart of growth over time

The key things are entering the initial amount, rate, compounding frequency, and time period accurately. Play with different scenarios to understand how compounding and time impact growth.

Contribution Frequency

Compound Frequency

Future Balance

?