The Power of Compound Interest

The Power of Compound Interest: How Small Savings Can Grow into Substantial Wealth

Compound interest is often referred to as the “eighth wonder of the world” – and for good reason. The power of compound interest can turn modest savings into life-changing wealth over time. While the concept may seem simple, the exponential growth it enables is truly remarkable.

So, what exactly is compound interest, and how can it work in your favor?

The Basics of Compound Interest

Compound interest occurs when the interest earned on a principal amount is reinvested, so that the interest also earns interest. In other words, you earn interest on your interest.

Let’s look at a simple example. Imagine you invest $1,000 at an annual interest rate of 5%. In the first year, you would earn $50 in interest (5% of $1,000). In the second year, you would earn interest not just on the original $1,000, but on the $1,050 total (the original $1,000 plus the $50 in interest earned the previous year). This means you would earn $52.50 in interest in the second year.

The key difference between simple interest and compound interest is that with simple interest, you only earn interest on the original principal amount. With compound interest, the interest earned each period is added to the principal, so you earn interest on a growing sum.

Sure, here’s a chart showing the growth of an initial $1,000 investment at a 5% annual interest rate compounded annually over 10 years:

| Year | Starting Balance | Interest Earned | Ending Balance |

|---|---|---|---|

| 1 | $1,000.00 | $50.00 | $1,050.00 |

| 2 | $1,050.00 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

| 4 | $1,157.63 | $57.88 | $1,215.51 |

| 5 | $1,215.51 | $60.78 | $1,276.29 |

| 6 | $1,276.29 | $63.81 | $1,340.10 |

| 7 | $1,340.10 | $67.01 | $1,407.11 |

| 8 | $1,407.11 | $70.36 | $1,477.47 |

| 9 | $1,477.47 | $73.87 | $1,551.34 |

| 10 | $1,551.34 | $77.57 | $1,628.91 |

As you can see, the interest earned keeps increasing each year because it is calculated on the principal amount plus the accumulated interest from previous years. This is the compounding effect.

In the first year, the interest is just 5% of $1,000 = $50. But in the second year, it’s 5% of $1,050 = $52.50. By year 10, the interest earned is $77.57 because it’s 5% of the larger base of $1,551.34 built up from previous years’ interest.

The Exponential Growth of Compound Interest

The true power of compound interest becomes apparent over longer time periods. Consider the following example:

- If you invest $10,000 at an annual interest rate of 7% and leave it untouched for 30 years, your $10,000 would grow to nearly $76,000.

- However, if you were to invest just $100 per month (a total of $36,000 over 30 years) at the same 7% annual interest rate, your account would be worth over $150,000.

The difference is remarkable – by contributing a relatively small amount each month, the power of compound interest allows your wealth to snowball over time. Even small, consistent contributions can add up to substantial sums.

The Importance of Starting Early

One of the most important factors in maximizing the benefits of compound interest is time. The earlier you start saving and investing, the more time your money has to compound and grow.

Consider two individuals, both of whom invest $5,000 per year. The first person starts at age 25 and invests for 40 years, while the second person starts at age 35 and invests for 30 years. Assuming a 7% annual interest rate, the first person would end up with over $1 million, while the second person would have around $500,000.

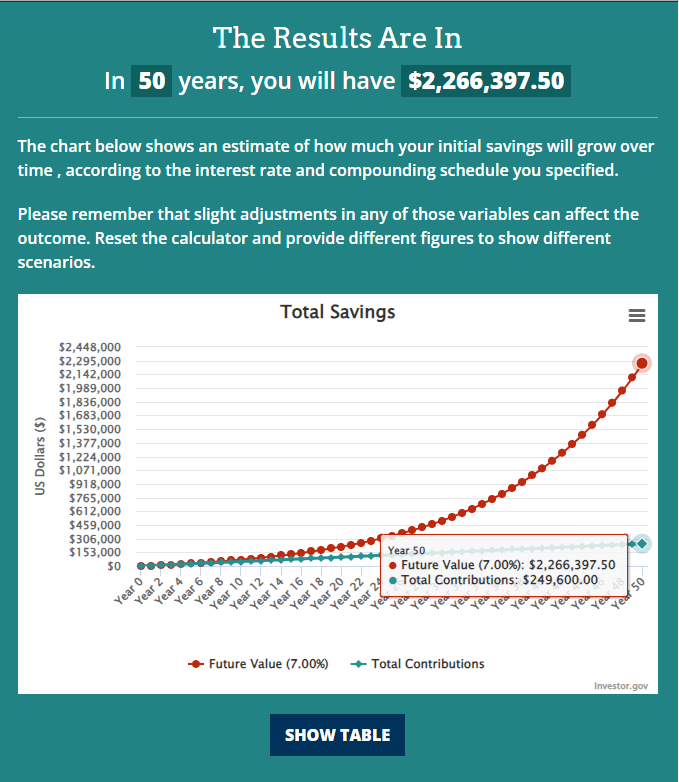

You can play with our Compound Interest Calculator on our site.

The difference highlights the exponential nature of compound interest. By starting 10 years earlier, the first person was able to earn interest on their interest for an additional decade, resulting in a significantly higher final balance.

Harnessing the Power of Compound Interest

Compound interest is a powerful tool that can help you build wealth over time. To maximize its benefits, consider the following strategies:

- Start saving and investing as early as possible, even with small, consistent contributions.

- Take advantage of tax-advantaged retirement accounts like 401(k)s and IRAs, which allow your money to compound tax-deferred or tax-free.

- Diversify your investments to balance risk and reward, and aim for a long-term average annual return of 7% or more.

- Avoid withdrawing from your investments prematurely, as this interrupts the compounding process.

- Be patient and disciplined – compound interest works best over long time horizons.

By understanding the power of compound interest and incorporating it into your financial plan, you can transform modest savings into substantial wealth over time. Start small, start early, and let the compounding work its magic.

Here are some useful websites with information on compound interest:

- Investor.gov – This website from the U.S. Securities and Exchange Commission has a simple compound interest calculator and explanations.

- BankRate.com – Offers articles, calculators, and tools to understand and calculate compound interest for various investment types.

- Khan Academy – The non-profit provides free video lessons and tutorials explaining compound interest concepts.

The key is understanding how compounding frequency, interest rates, timeframes, and contributions impact growth over time. Most sites have calculators along with written and video explanations.

Leave a Reply