Investing Strategies: 5 SIMPLE ways to MAXIMIZE Your Returns

Want to pump up your investment returns without resorting to complex investing strategies or taking on excessive risk? The key is sticking to a few straightforward, time-tested principles. Here are five simple yet powerful ways to maximize your returns:

Diversify Across Asset Classes

Diversifying across different asset classes is one of the core tenets of smart investing strategies. The main asset classes include stocks, bonds, cash/cash equivalents, real estate, and alternative investments like commodities or cryptocurrencies.

Within stocks, you’ll want exposure across different sectors, market caps, investment styles, and geographies. For example, holding large U.S. companies, small-cap value stocks, emerging market equities, and sector funds like healthcare or technology.

Bond exposure should span different maturity ranges and credit qualities from government bonds to corporate to municipal bonds. This prevents being overly exposed to risk from rising rates or defaults.

Real estate can include REITs, rental income properties, and real estate funds to gain exposure to both residential and commercial real estate.

Alternative asset classes like commodities, private equity, collectibles, or cryptocurrencies make up a small component for most investors but provide diversification from traditional stocks and bonds.

The right asset allocation mix depends on your goals, risk tolerance and time horizon. A young investor with decades until retirement may have 80%+ in stocks while a retiree may have a higher allocation to bonds and cash.

By spreading investments across multiple asset classes that don’t all move in lockstep, you can lower overall portfolio volatility and mitigate risks specific to any individual asset class. Diversification alone won’t assure positive returns but aims to smooth out the bumps along the way.

Regularly rebalancing by trimming winners and adding to laggards prevents any one area from over-concentrating. This disciplined approach of buying low and selling high helps maintain your targeted asset mix.

So while stocks, bonds, and real estate may be the core, exploring other non-correlated assets can add important diversification benefits that smooth the ride to your investment goals.

Keep Investing Costs Low

Investment costs may seem insignificant at first glance, but they can take an enormous bite out of your returns over the long run. Minimizing these costs should be a top priority of your investing strategies.

One of the biggest culprits is expense ratios on mutual funds and ETFs. A 1% annual expense ratio may not sound like much, but it compounds dramatically over decades. A $10,000 investment earning 7% annually would be worth around $80,000 after 30 years if the expense ratio was 0.1%. But with a 1% expense ratio, it would only grow to around $57,000 – over $23,000 less.

Look for low-cost index funds tracking major indexes like the S&P 500 with expense ratios under 0.2%. Avoid high-cost actively managed funds over 1% unless you have conviction the manager can beat the market over a long period.

Trading commissions are another drag. While trading fees have come down, frequent trading can still rack up meaningful costs over time. A $10 trading fee may not seem like much, but making 20 round-trip trades annually is $400 in costs.

Tax inefficiency from frequent trading of funds can also hurt returns versus a more passive, buy-and-hold approach focused on tax-efficient investing.

Other costs to watch include account fees, load fees on mutual funds, and advisory fees if working with a financial advisor. Ask for full transparency into all costs.

Simple steps like making one lump-sum investment instead of periodic investments can reduce costs. And opt for the lower-cost institutional or retirement share classes of funds when possible.

The key is being a cost-conscious investor. Minimizing investing fees and expenses through low-cost index funds and limiting excessive trading allows more of your money to keep compounding – leading to significantly higher net returns over decades.

Think Long-Term

One of the biggest mistakes investors make is having a short-term mindset driven by fleeting market movements, media noise, and emotional decision making. The most successful investors take a long-term, disciplined approach as one of their investing strategies.

The benefits of a long-term outlook are both mathematical and psychological. Mathematically, the longer you stay invested, the higher the likely probability of positive returns. Markets have historically risen around 2 out of every 3 years. But extend that to 10 or 20 year periods, and positive returns approach 90-95% of the time.

Short-term trading based on headlines and volatility often leads to buying high and selling low – the opposite of a prudent strategy. It also racks up transaction costs and potential tax liabilities from realizing frequent gains.

Psychologically, a long-term mentality insulates you from overreacting to short-term disruptions, “noise trading,” and emotional decision making that can derail your plan.

Equity markets have historically delivered around 10% annualized returns over multi-decade periods, despite regular pullbacks along the way. Trying to time those dips is extremely difficult.

Sticking to a long-term asset allocation matching your risk profile, with periodic rebalancing, is a time-tested approach. Tune out the noise and trust that short-term volatility and down periods are inevitable on the path to reaching long-term goals.

Market timing is also extremely difficult. Even missing just a handful of the market’s best single-day rallies can dramatically reduce long-term returns. Remaining invested through full market cycles is crucial to maximizing compound growth.

So while market fluctuations can be unsettling, adopting a “multi-year horizon” mindset keeps you focused on the long game versus reacting rashly to every blip. As the old adage says, time in the market beats timing the market.

Rebalance Regularly

Rebalancing is the process of periodically restoring your portfolio back to your desired asset allocation mix. This is one of the great investing strategies. It’s an important habit to prevent your portfolio from becoming overly concentrated in certain areas due to inevitable market movements.

Over time, different investments will rise and fall at different rates. For example, if stocks have a great run, they can end up forming an oversized portion of your portfolio compared to bonds or other assets. This increases your overall risk exposure beyond your original target.

Rebalancing forces you to trim back your winners and reinvest the proceeds into the lagging areas. This disciplined practice of buying low and selling high maintains your intended risk profile. It prevents your portfolio from drifting off track based on market forces.

There’s no set schedule, but many advisors recommend rebalancing annually or whenever your asset mix has shifted around 5% from the target. Or it can be done based on major milestones like receiving a windfall to invest or retiring.

The process is straightforward – determine your target mix, calculate your current mix, sell off appreciated assets exceeding their target until you raise enough cash, and reinvest that cash into underweight areas until you hit your targets.

Rebalancing is a disciplined way to manage risk, lock in gains in winners, and stick to your investing plan through a fixed process versus aimless response to markets.

However, it also triggers transaction fees and potential tax consequences from selling appreciated holdings. So there’s a trade-off between the benefits of rebalancing and the costs to do so, which is why many don’t rebalance too frequently.

Overall, regular rebalancing prevents your portfolio from taking on unintended risk over time due to asset drift. By trimming winners and adding to laggards, it enforces a contrarian “buy low, sell high” mentality that can boost returns.

Reinvest All Income Streams

One of the most powerful ways to turbocharge your returns over the long haul is to reinvest all income distributions from your investments. This allows the magic of compounding to work in your favor. This is one of the most important investing strategies.

Income streams from investments can come in various forms – dividend payments from stocks, interest payments from bonds, capital gains distributions from mutual funds, rental income from real estate, and more.

Rather than taking this income as cash flow, automatically reinvesting it back into the same investment allows those dollars to get reinvested and compound over time. Your money generates returns, which then generate their own returns, which compounds on itself repeatedly.

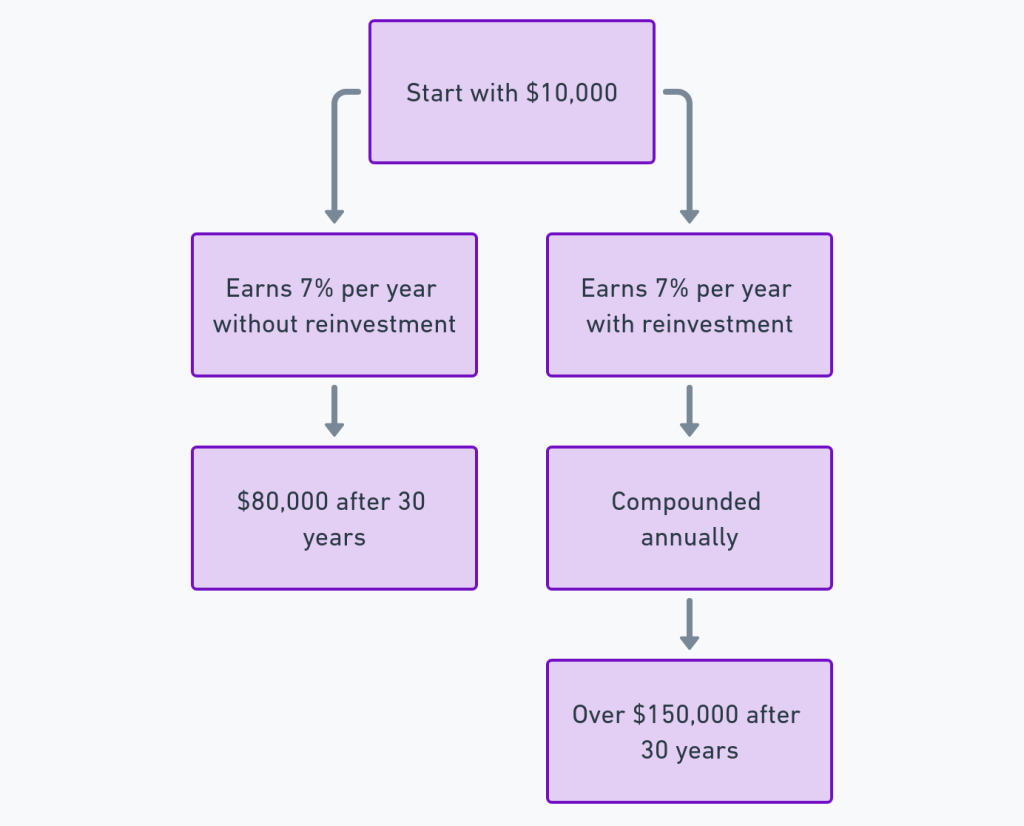

For example, a $10,000 investment earning 7% per year would be worth about $80,000 after 30 years. But if the 7% annual returns were reinvested to buy additional shares, that same $10,000 would grow to over $150,000 after 30 years from compounding. See Chart Below:

Reinvesting income streams means putting the entire return to work for you instead of just the original principal investment amount. It’s a way to put compound growth into hyper-speed without adding any new out-of-pocket contributions.

Most mutual funds, brokerages, and retirement accounts offer an option to automatically reinvest dividend and capital gain distributions to make this process seamless. With stocks, you can enroll in a dividend reinvestment plan (DRIP).

Taxes can complicate things, as reinvested income distributions may incur taxes even though you didn’t receive cash. But the power of deferred compounding can still outweigh that drag.

So while the income streams may seem small in any given year, those little reinvested amounts can mean a massive boost to your long-term net worth. Resist the urge to spend the income and instead reinvest every dollar to exploit the full potential of compounding.

Conclusion

While the proliferation of new investment vehicles and trading strategies may seem appealing, sticking to a simpler approach focused on these five principles can maximize your wealth over time. So tune out the noise and complexity – steady discipline toward these straightforward investing strategies is often the smarter move.

Leave a Reply