Investment Property Number 2: How I Bought It.

Seasoning money for a down payment on an investment property

One powerful technique I used to buy my second investment property was seasoning money.

Seasoning money refers to the practice of taking out a loan or transfer of funds, and letting that money season or age in your bank account for a period of time (typically 60-90 days) before using it for a down payment on a property purchase.

For our second property, a single-family home, we didn’t have enough for a traditional down payment. I had caught the real estate bug and convinced my wife to try this ‘seasoning money’ technique. I was eager to move forward instead of waiting to save up the money.

What to do to get another property?

As an investor, maintaining a good credit score is crucial. It opens doors to more financing options and lowers the cost of borrowing money. Lenders also look at your debt-to-income ratio to determine if they can lend you money for a mortgage. My credit score was good, and my debt-to-income ratio was low, which worked in my favor.

So in order to get a personal loan we needed to have the following:

- Good credit score – Lenders want to see a credit score typically above 600-640 to qualify for a personal loan. The higher your score, the better interest rate you’ll get.

- Verifiable income – You’ll need to provide proof of employment or income, such as pay stubs, W-2s, tax returns, or bank statements showing recurring deposits.

- Low debt-to-income ratio – Lenders prefer a debt-to-income ratio below 35-43%. This is your monthly debt payments divided by your gross monthly income.

- Collateral (for secured loans) – Some personal loans are unsecured, while others require collateral like a vehicle, real estate, investments etc.

- Personal information – You’ll provide details like your name, address, date of birth, social security number etc.

Seasoning the Money: The Details

To season money, I took out a $25,000 personal loan after consulting with my mortgage broker (Thanks Jay!!). They advised that if I held the money in my account for at least 60 days, the bank wouldn’t question its source when using it as a down payment. This technique essentially allowed me to finance 100% of the deal. Remember, there is risk here. You need to calculate your cash flow. Your cash flow needs to cover the loan payment as well as the mortgage payment. I always use dealcheck.io to analyze my deals. In my opinion it is the best deal analyzer out there.. and it is free.

Finding a Property

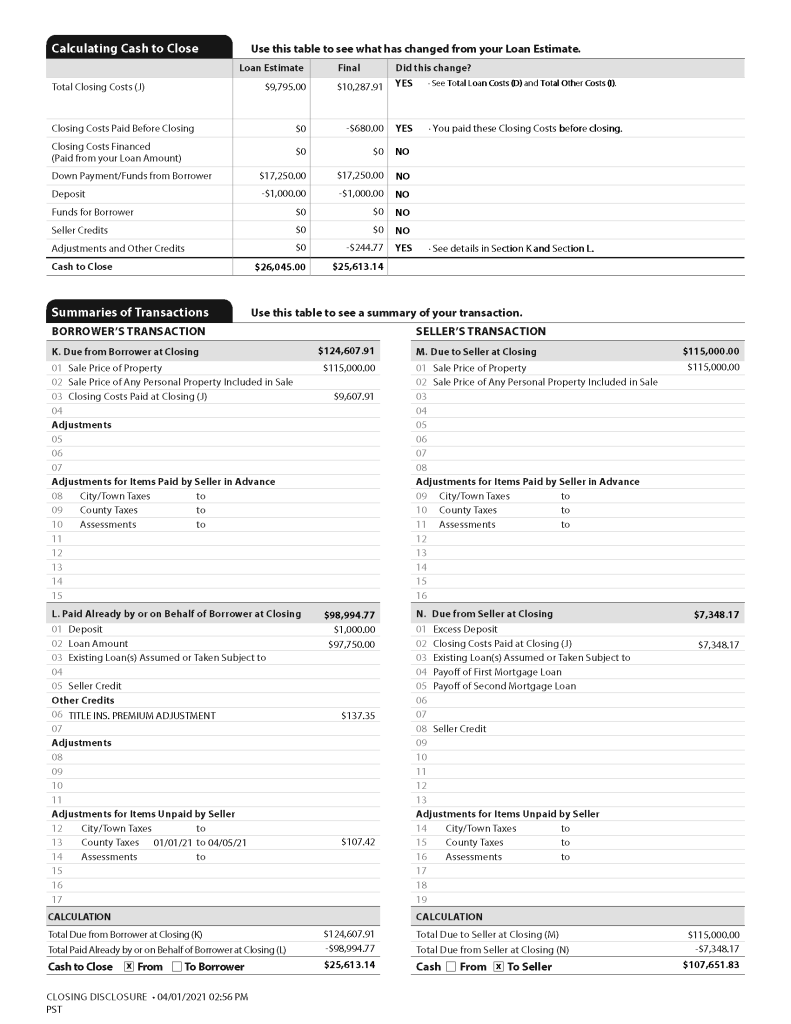

After 60 days, my wife and I started looking for a property. We found a value-add single-family home that needed some work for $125,000. It had issues like cockroaches, falling cabinets, and a smoke odor, but the structure was sound. We offered the seller $115,000. All in including closing costs ended up being $25,613.14. You can see the closing disclosure below.

We renovated the investment property by tearing out the cabinets, installing new appliances and lighting, painting with odor-killing paint, and putting luxury vinyl plank in the bedrooms. All in, I spent a little over $5000 on the renovation. During the renovation, I placed a “For Rent” sign with my phone number in the yard. This is the only advertising I’ve done for my single-family rentals. We ended up renting it out for $1250 a month to an older couple. It hit the 1% rule, so it was good for me. They still are renting it as I write this!

Refinancing to get the equity out of an Investment Property.

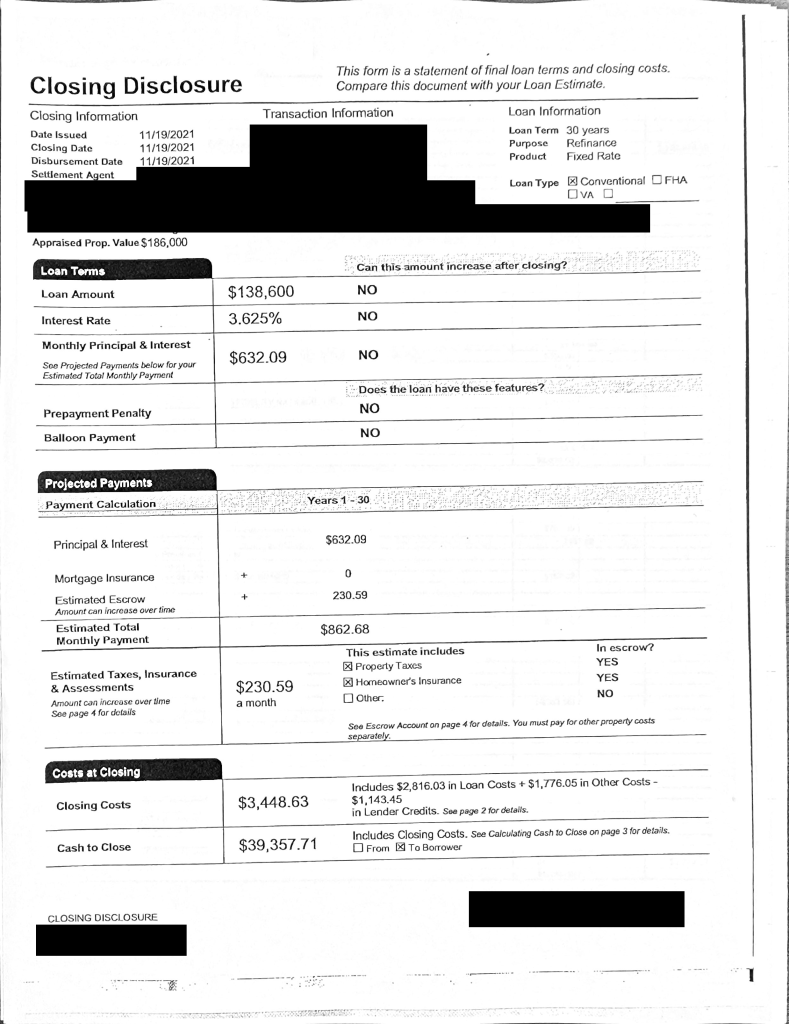

We ended up renting it out in May 2021. In November of 2021 we refinanced the property. We had renovated the property and had a quality tenant in place. We were able to take out $39,357.71 on a cash out refinance. The monthly payment was $862.68 after the refinance!! Now that was an exciting day. The closing disclosure is below.

So, now we had a rental property that we have negative equity in that pays us a couple of hundred dollars every month. Needless to day, we paid off the personal loan and began looking for the next property.

Leave a Reply